Signs of Identity Theft

Learn the tell-tale signs of identity theft, so that you can respond quickly and minimize your damages.

Learn the tell-tale signs of identity theft, so that you can respond quickly and minimize your damages.Early detection is always key when it comes to fighting identity theft. The sooner you find out your identity was stolen, the sooner you can take steps to prevent further damage and take corrective measures.

Here are the most common signs of identity theft you should watch for:

- Getting turned down for credit unexpectedly

Most identity theft victims discover they’ve been victimized when they’re unexpectedly turned down for credit. If your credit has been good and you were turned down unexpectedly:

- Demand an explanation (also called adverse action letter). It should explain the reason for the denial, and should state the name of the credit bureau that supplied the credit report used to process your application.

- Get your FTC’s mandated free credit report. Whenever you are turned down because of information that’s on your credit report – under the FACT Act you have the right for a free credit report on top of any other free report you’re entitled to (including your free annual credit report).

- Investigate that report thoroughly. Don’t leave anything unaccounted for.

- Unexpected phone calls from creditors

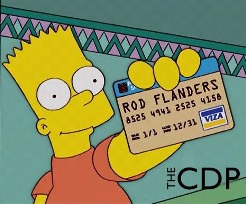

If you get a call from a creditor demanding payment for a purchase no one in your family can account for – have the caller give you all the information possible and investigate. - Strange credit card charges

Do go over your statements each month. It takes as little as 10 minutes, and is certainly time well spent

Many thieves that steal your credit card number start by making one or two small purchases once a month to test the card. Once they see that no one notices these purchases – that’s when they start to strike hard.

It’s easier to spot these test purchases if you keep all your receipts and reconcile them with your statements each month.

There’s also a hidden bonus – you may be able to spot subscriptions and re-accruing payments or services that you no longer need or didn’t remember to cancel. - Account usernames and passwords or ATM PINs suddenly stop working

This suggests that an identity thief may have changed your access codes. - Missing bills

If you’re used to getting statements and bills from your bank or other services you’ve subscribed to and the statements/bills stop arriving, it could mean an identity thief has changed your address in order to use your bank accounts without raising suspicion.

The same is true for any statements you opt to receive electronically. - Strange information in your files

If information in a personal file definitely does not match up with you, it could be simply a case of mistaken identity – or it could be more than an innocent mistake. One way to help avoid innocent mistaken identity problems is to use your middle name or middle initial on applications to help distinguish you from others who have the same name.

Return from Signs of Identity Theft to Identity Theft Page

Return from Signs of Identity Theft to Credit Report 101 Home Page